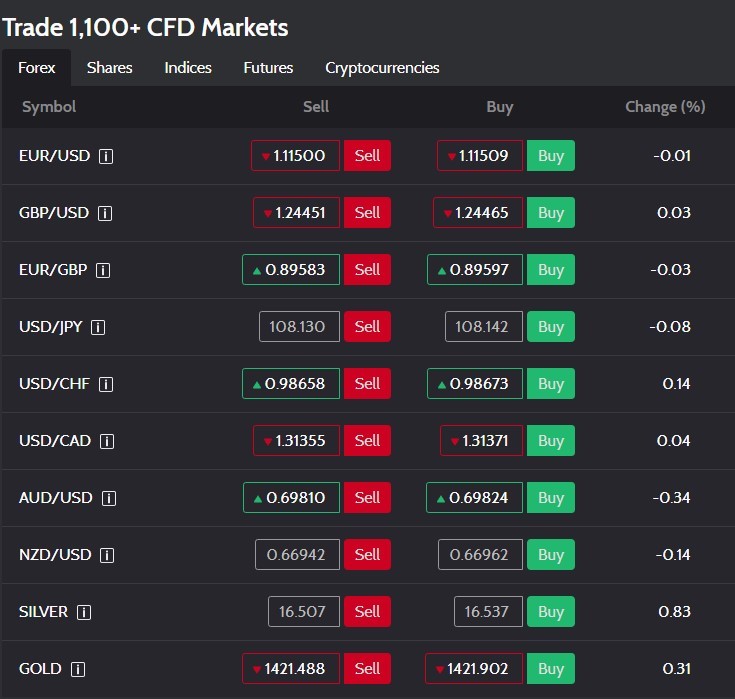

The DF Markets broker has been operating in the United Kingdom (UK) and the European Union for more than 7 years, offering more than 50 trading markets and more than 1,100 financial instruments. DF Markets is a reputable provider of spread and difference contracts (CFDs).

DF Markets offers traders a wide range of advantages, including:

- Individual customer support services

- Fully regulated by the FCA UK;

- Customer protection up to 50,000 pounds under FSCS;

- Traders have access to more than 1,100 markets across several asset categories.

Financial trading services provided through the DF Markets broker are only available to traders who have reached adulthood from regulated jurisdictions.

Broker’s regulation and security

DF Markets is based in Canary Wharf, in the heart of London and is a recognized provider of financial trading services including spread rates and CFDs. The company is fully licensed and regulated by the FCA (Financial Conduct Authority) with registration number 534027, and its customer protection services are provided by the FSCS. Segregated accounts (customer funds and company funds) provide ongoing protection to customers under the Financial Services Compensation Scheme.

The company is also registered in England and Wales with registration of the company No 0728 0005.

The broker has many years of experience in providing trading conditions, ensuring compliance with requirements, strict safety standards and codes of conduct. All traders are treated like VIPs from the moment of registration to withdrawal of money. Customers can trade in a demo mode or simply create a real account and start making a profit from the beginning.

Safety and security are highly valued at DF Markets. Clients’ funds are stored in leading banks, in separate bank accounts.

DF Markets has no debts and has significant liquidity to ensure compliance with the regulatory framework, which is an indicator of the broker’s reliability.

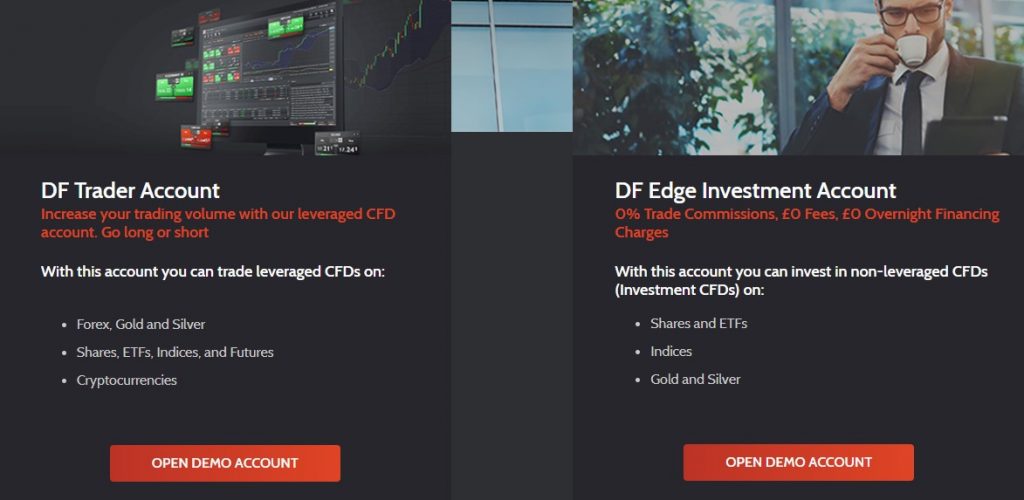

Account types and trading software

DF Markets offers customers the option of a demo account and a real account. The demo account option allows traders to practice trading in real market conditions without a deposit. Customers must register online to start trading (spread bets) from a demo account. The demo account provides customers with a demo trade balance of £10,000 (training balance), and registration is available through Facebook and Google.

The trading platform includes spreads on goods, stocks and currency pairs. A wide range of tools and resources are available, and traders can easily apply different trading strategies to develop their skills.

A real account usually requires traders to provide supporting documents. Once registered, traders can be sure that the real account will be opened during the working day.

DF Markets is easy to navigate. This trading platform carefully categorizes topics such as trade, analysis, educational tools and resources, as well as information about the company. The ability to trade in a demonstration mode or real money mode makes it easier to get started. The homepage lists the 1,100 q markets currently available with quick-clicking features such as buying or selling forex, stocks, indices and futures. Traders can also see the most traded instruments with the mood of live traders. Market engines (the biggest winners and losers of the day) are also on display. News articles are published to help traders make the most of trading activity on the site.

Several trading platforms are available for DF Trader customers. These include:

DF WebTrader SB: does not require the installation of any software and works without problems with laptops and PCs. Traders can easily place orders on more than 1,100 financial instruments, including stocks, commodities, indices, currencies and more. This trading platform has more than 40 technical indicators, 256-bit encryption, full compatibility with all browsers, statistical analysis and other elements.

DF Mobile SB: focused on the functionality of mobile trading directly from a tablet or smartphone. The app has been specially designed for active traders and allows you to trade more than 1000 financial instruments, quickly and easily deposit and withdraw funds, conduct daily analysis, determine prices in real time and update information about traders. This app can be easily downloaded and installed on any mobile device.

DF Trader SB: Designed for spread bets. It is focused on trading currency pairs and is fully configured. Features of DF Trader SB include trailing stops, low commissions, spreads at competitive prices, Mac and Windows functionality, professional graphics packages and trading statistics.

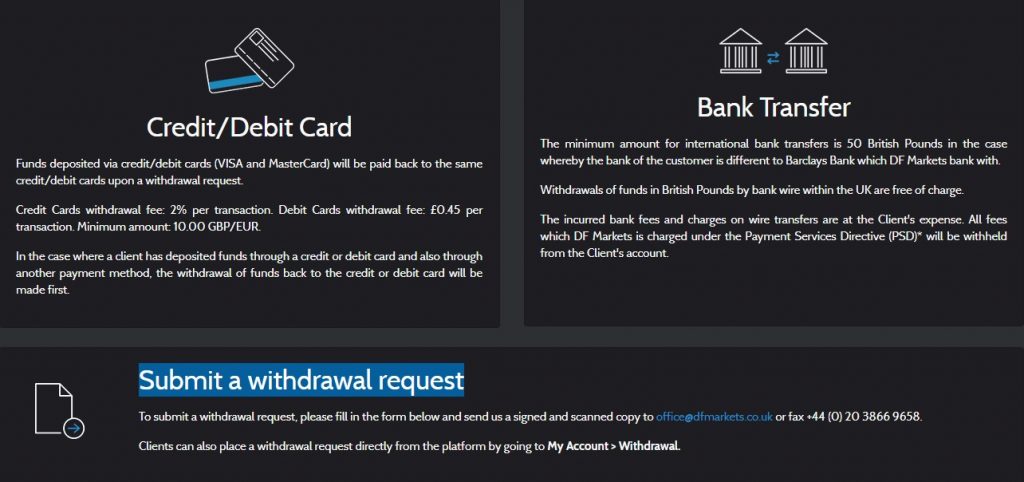

A variety of deposit options are available, including credit and debit cards (Visa credit cards, Visa and MasterCard debit cards), as well as bank transfers. The minimum deposit amount for a credit or debit card is 10 or 10.

The range of markets available to traders includes forex, silver and gold, stocks, indices, futures and ETFs.

The platform has several security features built into the platform, such as SSL encryption, firewall protection, account verification, full licensing, FCA regulation, and individual accounts.

The broker offers traders a wide range of educational tools and resources like video guides, tutorials, comprehensive training courses, and the most advanced technology on the market.

Customer support options include social media, chat functionality, phone, email, and regular email. Customer support is provided through social networks, live chat, phone, electronic and regular.

Support representatives are working to provide professional support to traders.

As a conclusion, our review of the broker DF Markets made it possible to understand that this broker is a leading provider of financial trading with CFDs and spread betting options. Customers benefit from many favorable trading conditions with the broker, including zero minimum deposits, zero commissions and competitive spreads among others. We believe that with this broker you can safely earn!