Hello, today we will tell about Pavel Svantsev and tell about his accounts PAMM account No.7031 and PAMM 2.0 account No.18550. Pavel Svantsev is a well-known figure in trading circles.

This man was born in Kiev, and now lives in one of the Mediterranean countries, devoting a lot of time to trading on forex. In the financial markets, it feels like a fish in the water, becoming one of the most successful traders of our time. Paul trades under the nickname Sven, and his trading accounts occupy a leading position in the final ratings of Fx-Trend.

Pavel made his first forex trades in 2008. Then he had a relatively large sum of 13 thousand dollars on his hands. As Paul admitted in one of his interviews, this amount was not his, but it fell into his hands on time, because even then he had his own trading system, which brought him in a couple of months about 28% of the profits. It must be said that at that time Paul did not seek ultra-high profits, trying to minimize risks, and therefore approached trade conservatively, receiving 10-12 percent of monthly income.

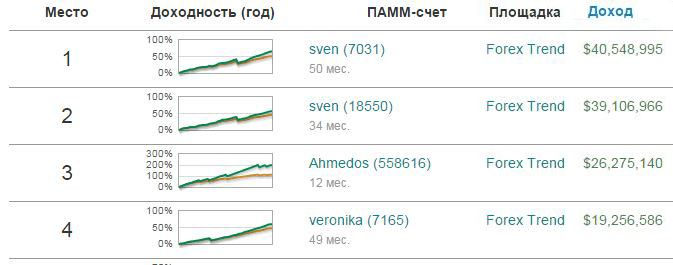

To understand how good trader Pavel Svantsev is, take a look at the rating of accounts. The rating is based on the principle: the amount of income of the PAMM account for the entire time of its operation. It is the “income” that we all wonder who is the first and who earns the most for their investors.

Oh, my! Both of Paul’s accounts occupy the top two positions. I think the question about the reliability of this trader is closed.

The trader’s working day begins with the search for the best conditions for entering the market. And then everything is subject to the principle: “As long as in the market – you take risks, when you leave the market – you exclude the risk.” Sven tries to stop trading when receiving 3-5% profit for the week, based on the above principle. If the entrance to the market is not properly executed and a loss-making transaction is formed, then Sven intentionally closes the deal with fixing the loss, acting as a surgeon, cutting off the limb to the person, saving him from gangrene. According to Sven-a, there is no need to be afraid to recognize a loss-making deal to eliminate it on time.

Score 7031

| General information | |

|---|---|

| Trade period (TP) / end of period | 4 not / 11 Jan |

| Starting capital | $3,000 |

| Minimum contribution/share of profit | $200 / 60% |

| Agent’s Reward for Attraction/Profit | 1.00% / 3.00% |

| Penalty for early withdrawal | 30% |

| Investor Capital (KI) | $14,922,599 |

| Capital Manager (KU) | $18,786,814 |

| Contribution insurance (cost/deductible) | 1.0% / 5.0% |

| Investor for a month (without/reinvest.) | 5.26% / 5.32% |

| Investor for three months (without/reinvest.) | 17.67% / 18.85% |

| Investor for six months (without /reinvest.) | 24.27% / 26.51% |

| Investor for the year (without/reinvest.) | 52.88% / 67.40% |

| Average investor week / median | 1.01% / 1.10% |

| Best/worst investor week of the year | 3.25% / -7.74% |

| Sharp Ratio | 0.47 |

| Maximum drawdown per TP / per year | 0.00% / 17.10% |

As we can see everything is clearly represented the trading period one week. Not a large amount of balance. The maximum drawdown at Paul is 17%, it is not as much as it may seem, because if we look at the details of the account, everything will become clear.

You can insure your contribution with the help of Astra Insurance, it will calm your nerves, the account is protected as much as possible and the money will not go away.

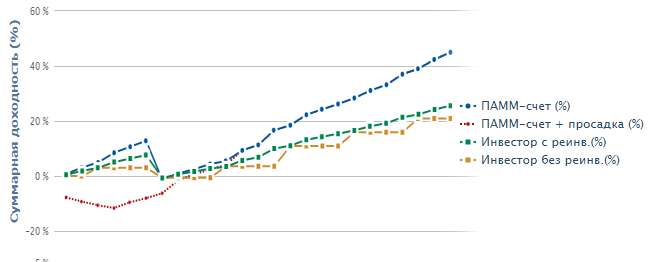

Yield chart, account 7031

Judging by the schedule, we see how smoothly the capital of Paul and investors grows smoothly, the only thing that can be noticed is not stable capital growth without reinvestment, the question lies the answer. But, mind you, even without reinvestment, your capital will give “z” at the end of the year.

In order to consolidate the chart, consider the yield in the numbers.

- 2010. PAMM account: 855.22%, investor: 241.31%, amount: $87,337

- 2011. PAMM account: 1102.80%, investor: 256.04%, amount: $3,429,802

- 2012. PAMM account: PAMM account: 240.54%, investor: 89.47%, amount: $4,829,855

- 2013. PAMM account: 126.93%, investor: 51.23%, amount: $10,068,500

- 2014. PAMM account: PAMM account: 134.97%, investor: 67.40%, amount: $22,133,500

The sums are growing in seven-mile steps, and investors’ income is also growing. Those who have invested in Paul for a long time, have already earned a lot, perhaps soon will start opening their PAMM accounts and will trade themselves.

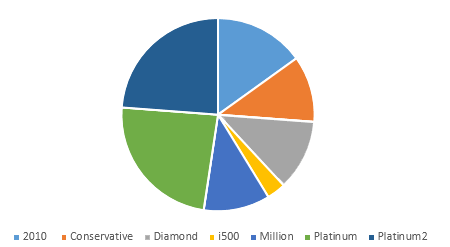

Score 7031 in PAMM indices

The PAMM index is an indicator of several PAMM accounts of different traders.

You can invest your money not only in the PAMM accounts of specific traders, but in several traders, using indices, thereby reducing potential risks.

Benefits of PAMM indices:

- By investing in a new PAMM index tool you can operate a small amount and decompose it into the best traders.

- The trading period is one week, even though traders can put in their offer 4 weeks.

- Convenience and visibility of investment – the whole process and statistics are conducted in the trading terminal Metatrader.

Account share 7031 in indices

| Index name | Share | Minimum contribution | Revenue for the month (without/reinvest.) |

|---|---|---|---|

| 2010 | 19% | $200 | 5.00% / 5.09% |

| Conservative | 14% | $100 | 4.17% / 4.23% |

| Diamond | 15% | $200 | 5.32% / 3.77% |

| I500 | 4% | $200 | 0.79% / 0.76% |

| Million | 14% | $200 | 4.10% / 4.16% |

| Platinum | 30% | $200 | 4.81% / 3.37% |

| Platinum2 | 30% | $200 | 5.48% / 3.81% |

Investing

What to do? What to do? How to invest?

Paul is one of the most successful Forex traders and his PAMM account is suitable for conservative portfolios. The entry point, in principle, is not important – drawdowns happen too rarely to wait for them. As soon as you decide, act. The minimum entry threshold is small – only $200. So you don’t have to invest in the index. Paul has not had any drawdowns lately, do you think it’s worth waiting for? Paul has been thinking about his strategy for years, and now shares it with everyone in the form of earned $.

Invest and get the money!!! Invest directly in the PAMM account, only $200 and went!

Invest account 7031

Don’t forget the rule. Invest now – that would get money later. Your money loses value by the second, act!

Investing in PAMM Indices

Although the minimum threshold is only $200. Some prefer indexes, right, so too can, the more risks are reduced.

Invest in indices 7031

PAMM Score 2.0 – 18550

| General information | |

|---|---|

| Trade period (TP) / end of period | 4 not / 4 Jan |

| Starting capital | $2,000,000 |

| Minimum contribution/share of profit | $10,000 / 50% |

| Agent’s Reward for Attraction/Profit | No/no |

| Available for investment (PAMM2.0) | $47,909,054 |

| Investor Capital (KI) | $7,707,394 |

| Capital Manager (KU) | $26,191,004 |

| Contribution insurance (cost/deductible) | 0.2% / 5.0% |

| Investor for a month (without/reinvest.) | 4.24% / 4.28% |

| Investor for three months (without/reinvest.) | 13.29% / 13.96% |

| Investor for six months (without /reinvest.) | 18.41% / 19.63% |

| Investor for the year (without/reinvest.) | 46.71% / 57.64% |

| Average investor week / median | 0.89% / 0.90% |

| Best/worst investor week of the year | 2.83% / -6.23% |

| Sharp Ratio | 0.82 |

| Maximum drawdown per TP / per year | 0.00% / 16.30% |

Pay attention to the initial capital, I think the arguments in Paul’s account, good trader or not superfluous. But here, and the madness of the entrance is not as much as $200, and no matter how many of the $10,000. On this account the maximum drawdown of only 13% it allowed investors to mainly earn.

There are no risks here, who will risk such a sum? And when investors are behind us. Paul is so careful that it was only in August that there was a drawdown. The table is not much different from the 7031 bill, and why invent a bike if everything works.

Yield

The account has been working relatively recently, but has already shown itself as a leader. What can be seen by the yield.

- 2012. PAMM account: 227.01%, investor: 84.74%, amount: $8,601,966

- 2013. PAMM account: 125.96%, investor: 51.34%, amount: $9,471,000

- 2014. PAMM account: 142.91%, investor: 57.64%, amount: $21,034,000

What is PAMM 2.0

Pamm 2.0 technology differs from conventional PAMM accounts in that, in addition to the distribution of income, risks are also distributed.

Now, if you put money into the account, you risk only half or the part that the trader deems acceptable. Paul now has a 50% responsibility.

How does it work?

If you put $10,000 into your account, in the event of a loss-making month, you will lose money with only $5,000, the rest will not be touched. It’s tempting isn’t it? You can now always be calm for your money. Pamm 2.0 was developed with all the wishes of investors, because the forex market cares about those who work with it.

The score of 18550 is one of Paul’s most successful endeavors. He occupies absolute leadership positions in the ranking. It was opened in early 2012 with a level of responsibility of 50%. During the trading on this account, Paul showed only two unprofitable monthly periods. This account makes up significant stakes in PAMM Indices such as Diamond and Million-2.

The high and stable profitability of Pavel Svantsev’s accounts has long been the most significant argument in favor of attracting investment funds. The presence of Sven accounts in the indices of leading PAMM accounts and in the portfolio structure of PAMM-Funds remains an important argument in this case.

Success to each of the traders comes completely differently. In the case of Pavel Svantsev, he came to him even when he, as a trader, made his first transactions on the capital of 13 thousand dollars. In the future, his trade was more conservative and methodical, which allowed Sven to reach the first of his million in the account of 7031. Now Paul’s success has become more solid thanks to the opening of a PAMM 2.0 account, which obliges the trader to insure the investments of his investors. So today among Paul’s clients there are a lot of public people who want to increase their savings, and therefore they trust the professionalism of a successful trader.

Investing

Score 7031. Pavel is one of the most successful, we can say the leader of the forex market, the holder of records. A man who knows how to keep a mark. Paul at one time did not wait and began to earn, so that as soon as you are ready to invest. The minimum entry threshold is not high, $200, you can not use indices, but invest directly.

With an account of 18550, more complicated as you remember, the minimum threshold of $10,000, if you have such money, you can safely allocate them from your investment portfolio. If there is no such money – you will have to buy indices that work not so long ago, which means that they have not yet passed the test of time.

| Index name | Account share 18550 | Minimum contribution | Revenue for the month (without/reinvest.) | Investor |

|---|---|---|---|---|

| Diamond | 15% | $200 | 5.23% / 5.34% | Invest |

| I500 | 4% | $200 | 0.89% / 0.86% | Invest |

| Million2 | 17% | $200 | 3.03% / 3.05% | Invest |

Invest and get the money!!! Invest directly in a PAMM account, a minimum contribution of $10,000

Invest account 18550