Peter Lynch is one of the brightest members of the same generation of financial gurus as Bill Gross, Victor Niederhoffer and Jack Schwager. This American businessman and stock investor is a graduate of Boston College and The Wharton Business School at the University of Pennsylvania. An important role in his professional activities was played by work in the international financial corporation Fidelity Investments – in fact, the most successful mutual fund in the world. Equally well-known are peter Lynch’s books, “Playing Wall Street” and “Fighting with the Current.”

Work at Fidelity Investments

Peter Lynch got an internship at Fidelity Investments in 1966. Not least, this employment was related to the acquaintance with the president of the company: as a young man, Lynch moonlighted at the golf club in Massachusetts, where he played. Initially, the new financier’s responsibilities included analysis of the chemical industry, paper production, and publishing.

After graduating, Peter Lynch served two years in the Army before returning to Fidelity Investments as a full-time employee. Its area of responsibility has expanded to include textile, mining and metallurgical industries in addition to the chemical industry. Over the years, a career ladder has led Lynch to the position of Director of Research and Analytics.

Magellan Fund Management.

Beginning in 1977, Peter Lynch was appointed director of the then little-known Magellan Fund, which had assets totaling $18 million. During 13 years of fund management, the financier managed to turn this amount into 14 billion dollars and more than 1000 exchange positions. During this period, Magellan, on average, earned 29.2% of profits.

When calculating statistics for 20 years in 2003, it turned out that the growth rates of this mutual fund were the highest in the history of organizations of this type. Peter Lynch has also made outstanding progress with Philip Morris, Volvo, Ford, MCI, General Electric, Lowe’s and others. According to The Intelligent Investor’s Jason zweig, Lynch is worthy of legendary investor status. At the age of 46, the outstanding financier decided to retire and devote himself to philanthropy.

Investment Method and Books by Peter Lynch

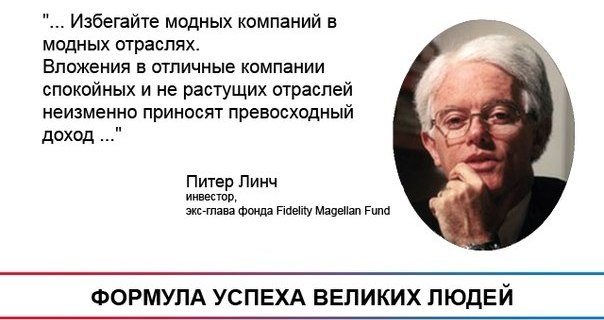

Books owned by Peter Lynch are downloaded and bought by hundreds of copies every day – the success of this talented investor is a great role model. He considers the analysis of the industry and the financial situation of the company, as well as observation, as well as the main benchmarks in his activities. According to Lynch, an attentive layman is sometimes able to detect promising businesses even before they are addressed by “sharks from Wall Street.”

Peter Lynch also focuses on endurance and the ability to listen to professionals. Actually, he willingly shares the “technical” nuances of his approach to making money in publications and during speeches. An exhaustive characteristic of many stock market secrets is present in the book “The Peter Lynch Method”; “Replay Wall Street” is also popular among traders and investors precisely due to attention to detail and practical advice. The methods offered by the expert to assess and interpret financial indicators can be mastered by almost everyone, regardless of the availability of specialized education. Equally well known is Peter Lynch’s publication “Fighting the Current.”

Lynch’s extraordinary mindset and absolute rationalism helped him develop an effective approach to investing based on diligence, attentiveness and openness to new information. Today, many of his books can only be purchased, but also download: “Peter Lynch’s Method” and “Play Wall Street”, in particular, have become widespread in the network.

- Peter Lynch Method peter Lynch. Strategy and tactics of the individual investor download

- Peter Lynch to Replay Wall Street download